What is a Trading session?

What is a trading session? Trading sessions in the forex market refer to the active trading hours of financial centers or specific regions around the world. These meetings or trading meetings are known by the names of major financial cities that are most active in the forex market.

These big financial centers are London, New York, Tokyo and Sydney. Forex trading sessions are a vital aspect of the global currency market and each session presents unique opportunities and challenges for traders. Understanding the characteristics of each trading session is critical to developing successful trading strategies and maximizing profits. The purpose of this article is to examine the exact hours of forex trading sessions (in Iran time) and the characteristics of each. Stay with us.

Table of Contents

- What is a trading session in Forex?

- Features of forex trading sessions

- Australian trading session (Sydney)

- Asian trading session (Tokyo – Japan)

- European trading session (London – England)

- American trading session (New York)

- Forex trading sessions on Iran time

- Overlapping trading sessions

What is a Trading session in Forex?

Trading sessions in the forex market refer to the active trading hours of financial centers or specific regions around the world. These meetings or trading meetings are known by the names of major financial cities that are most active in the forex market. The most important trading meetings of the forex market are:

- Sydney trading session in Australia

- Tokyo trading session in Japan

- London trading session in the UK

- New York trading session in America

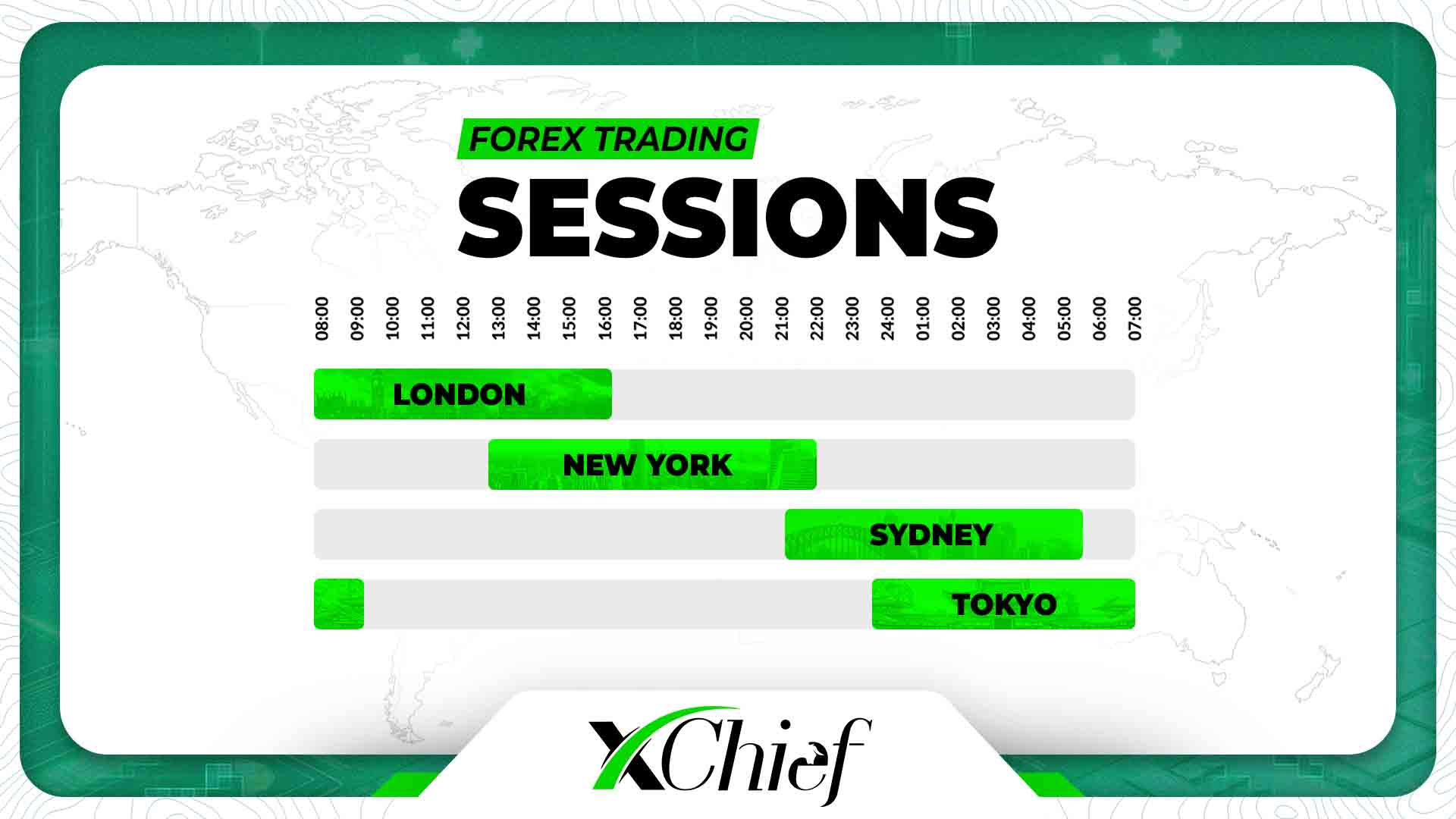

In fact, a trading day in the forex market is made up of these 4 trading sessions, and the largest volume of transactions in a day is related to these financial centers. Forex market is active on all days of the week (except Saturday and Sunday). The market opens on Monday, when the Reserve Bank of Australia opens in Sydney. In the rest of the day, the market will be followed by the trading session of the Bank of Japan (Tokyo) and the Bank of England (London) and after that, it will end with the last and most important trading session, the session of New York in America. Since these 4 trading sessions operate consecutively and cover the whole day, Forex is open 24 hours a day. Actually, after the end of the New York session, the Sydney trading session will start again in Australia, and this sequence will make the forex market to remain open continuously throughout the week. The market is only closed on public holidays and weekends, as central banks are closed on these days. In the image below, you can see the overlap and sequence of important forex market sessions:

The most important forex trading sessions

Features of forex trading sessions

Although Forex is open 24 hours a day, it does not mean that it has the same activity at all hours of the day. In some hours of the day, the market has a short fluctuation range and is not suitable for trading, and on the contrary, in some hours of the day, the market fluctuates well and there are good opportunities for trading. The reason for this difference is the change in market liquidity. In fact, the higher the liquidity of the market, the more the price fluctuates and there are good opportunities for trading, while with the decrease of the liquidity of the market, the range of price fluctuation becomes much more limited. This market behavior is due to the change of trading sessions. Because every Forex trading session has its own characteristics. In fact, each meeting is a unique trading environment, because it is influenced by factors such as liquidity and currency type. By carefully examining these sessions, traders can choose the optimal times to trade and perform better risk management. Whether you are an experienced trader or a novice trader, understanding the characteristics of each trading session is essential for successful forex trading. In the following sections, we examine the key features of each trading session, discuss the exact time of each session and the impact of important news events and economic data.

Australian trading session (Sydney)

The Australian (Sydney) trading session is the first trading session in the forex market, where two important central banks of Australia (RBA) and New Zealand (BNZ) operate. The Sydney session and the Tokyo session are also called the Asian session in the forex market. The Sydney trading session starts at 7am Sydney time (AEST) and is open until 4pm Sydney time (AEST). In other words, on all days of the week except Saturday and Sunday, the Australian forex session opens at 7am Australian and closes at 4pm Australian, unless that day is a public holiday in the Australian calendar. The Sydney trading session overlaps with the Tokyo session during the hours of the day, which we will examine in more detail in the section on the overlap of sessions. The Sydney session in the forex market has the lowest liquidity compared to the other 3 sessions, and usually fewer traders trade in this session. To see the exact time in Sydney, just search AEST in your browser. The best symbols to trade in the Sydney session are currency pairs with either the Australian dollar (AUD) or the New Zealand dollar (NZD) on one side. In other words, the best symbols for professional trading in the Sydney session are:

- AUDUSD currency pair

- EURAUD currency pair

- AUDJPY currency pair

- NZDUSD currency pair

- NZDJPY currency pair

If you intend to do Day Trading or scalping in the Australian session, you can use these symbols, but for long-term trading, there is no need to be sensitive to the hours of the trading sessions or the desired symbol.

For long-term trading, you should simply follow your trading strategy and monitor the news and fundamental forces. Another important point for trading in the Sydney session is to pay attention to the important economic events and news of Australia and New Zealand, because trading in this session, regardless of the news and data of the economic calendar, is very risky. Therefore, always check the important news of Australia and New Zealand before starting trading and make the necessary decisions based on your trading system. The most important data to consider when trading AUD and NZD currencies are:

- Unemployment Rate

- Retail Sales Rate

- Consumer Price Index (CPI)

- Central Bank of New Zealand Official Cash Rate

- Central Bank of Australia Official Cash Rate

Asian trading session (Tokyo – Japan)

The Japan (Tokyo) trading session is the second trading session in the forex market in which the Bank of Japan (BOJ) operates. As mentioned, this session, along with the Sydney session, is called the Asia session, which also overlaps with each other at certain times of the day. The Tokyo trading session starts at 9:00 a.m. Tokyo time (JST) and is open until 6:00 p.m. Tokyo time (JST). In other words, on all days of the week except Saturday and Sunday, the Tokyo Forex session opens at 9:00 a.m. Japan and closes at 6:00 p.m. Japan, unless that day is a public holiday in the Japanese calendar. To see the exact time in Tokyo, just search the term Japan standard time in your browser. The Tokyo trading session has a significant place in the forex market, because Japan is the third largest forex trading center in the world. This meeting, although known as the Tokyo meeting, also includes other meetings such as the Hong Kong and Singapore meetings. The best symbols to trade in the Tokyo session are currency pairs with the Japanese yen (JPY) on one side, as it accounts for 16.5% of all forex trading during these hours. In other words, the best symbols for professional trading in the Tokyo session are:

- USDJPY currency pair

- EURJPY currency pair

- AUDJPY currency pair

- CADJPY currency pair

- GBPJPY currency pair

- CHFJPY currency pair

Another important point for trading in the Japanese session is to pay attention to the important economic events and news of Japan, because trading in this session, regardless of the news and data of the economic calendar, is very risky. Therefore, always check the important news of the yen (JPY) before starting trading and make the necessary decisions based on your trading system. The most important data that you should keep in mind when trading yen (JPY) are:

- Gross Domestic Product (GDP)

- Tokyo Core CPI and National Core CPI data

- Bank of Japan Policy Rate

- Press Conference of the Central Bank of Japan

Although the Tokyo trading session has more liquidity than the Sydney session, in general, trading in Asian sessions also has risks, because these sessions have less liquidity compared to other important trading sessions such as Europe or America, and this can cause an increase in spreads or Slippage during transactions. Also, Asian sessions have a shorter price fluctuation range than European and American sessions, and this makes it less attractive.

European trading session (London – England)

The European trading session (London) is the third trading session in the forex market, in which important central banks such as the Bank of England (BOE), the European Central Bank (ECB), and the German central bank (Deutsche Bundesbank) operate.

The London trading session starts at 8:00 a.m. London time (GMT+1) and is open until 5:00 p.m. In other words, on all days of the week except Saturday and Sunday, the European Forex session opens at 8:00 AM in London and closes at 5:00 PM in London, unless that day is a public holiday in the UK or European countries. The London trading session overlaps with the New York session during the hours of the day. The London session in the forex market has the most liquidity compared to the other 3 sessions, and usually most traders trade in this session. To see the exact time in London, just search Time in London in your browser.

London is considered the forex capital of the world and about 43% of all forex trading takes place during this session. The best symbols to trade in the London session are currency pairs with either the British Pound (GBP) or the Euro currency (EUR) on one side. In other words, the best symbols for professional trading in the London session are:

- EURUSD currency pair

- EURAUD currency pair

- GBPJPY currency pair

- GBPUSD currency pair

- EURJPY currency pair

- GBPNZD currency pair

Another important point for trading in the London session is to pay attention to important economic events and news in England and Europe, because trading in this session, regardless of the news and data of the economic calendar, is very risky. Therefore, always check the important news of England and Europe before starting trading and make the necessary decisions based on your trading system. The most important data that you should consider when trading GBP and EUR currencies are:

- Unemployment Rate

- Retail Sales Rate

- Consumer Price Index (CPI)

- Gross Domestic Product (GDP)

- The Official rate of the Central Bank of England

- The Official rate of the Central Bank of European

American trading session (New York)

The American (New York) trading session is the fourth and last trading session in the forex market, where the world’s largest central bank, the US Federal Reserve, operates.

The New York trading session starts at 8:00 a.m. New York time (UTC-4) and is open until 5:00 p.m. In other words, on all days of the week except Saturday and Sunday, the New York forex session opens at 8:00 AM in the US and closes at 5:00 PM in the US, unless that day is a public holiday in the US calendar. The New York meeting has the most liquidity in the forex market after the London meeting, and many traders trade in this meeting. To see the exact time in New York, just search the term NY Time in your browser.

It is the second largest trading session in terms of trading volume, accounting for about 17% of all forex trading. Also, if you intend to trade global gold (XAUUSD), the New York session is the best choice for you, because during this session, gold experiences the most volatility during the day. In fact, the best symbols to trade in the New York session are currency pairs that have the US dollar (USD) on one side. In other words, the best symbols for professional trading in the New York trading session are:

- EURUSD currency pair

- GBPUSD currency pair

- USDJPY currency pair

- NZDUSD currency pair

- USDCAD currency pair

- XAUUSD currency pair

Another important point for trading in the New York session is to pay attention to important American economic events and news, because trading in this session, regardless of the news and data of the economic calendar, is very risky. Therefore, always check the important news related to the US dollar before starting trading and make the necessary decisions based on your trading system. The most important data that you should keep in mind when trading USD currency are:

- Unemployment Rate

- Non-Farm Payroll (NFP)

- Retail Sales Rate

- Consumer Price Index (CPI)

- Gross Domestic Product (GDP)

- Federal Funds Rate

- The Federal Open Market Committee Press Conference (FOMC)

Forex trading sessions on Iran time

The opening and closing hours of forex trading sessions are as follows:

- Sydney session opening and closing hours: 00:30 to 9:30 Tehran time

- Tokyo session opening and closing time: 03:30 to 12:30 Tehran time

- London session opening and closing time: 10:30 to 19:30 Tehran time

- New York session opening and closing time: 15:30 to 00:30 Tehran time

Overlapping trading sessions

Overlapping trading sessions in Forex refers to a period when two important sessions are open at the same time.

Three overlaps occur in the forex market, which are:

- Overlap of the Sydney session with the Tokyo session (from 9 am to 3 pm Tokyo time)

- Overlap of the Tokyo session with the London session (from 8 am to 10 am London time)

- Overlap of the London session with the New York session (from 8:00 AM to 12:00 PM New York time)

In the overlaps of the forex market, due to the intersection of two trading sessions, the volume of transactions increases greatly, and this leads to the creation of attractive profitable opportunities in the market with its large fluctuations. Also, due to the high liquidity in the market, the spread of trading symbols should be reduced to an acceptable level. Therefore, if you intend to do day trading or scalping, the best time to trade is overlapping sessions. The most important and longest overlap in the forex market is the overlap of the London session with the New York session, which occurs at 15:30 to 19:30 Iran (Tehran) time. The volume of transactions reaches its peak during these hours of the market and we see large fluctuations in the market. Also, usually in this overlap, the most important economic news of the world, i.e. economic news and data of the US dollar, is published, and this affects the market a lot. Most traders enter the market during these hours, but note that trading in the overlap of the London session with the New York session requires a lot of skill and experience, and be sure to practice enough in demo or test accounts before starting real trading.

Final Word

In this article from xChief Academy, we examined the trading sessions of the forex market in Iran time (Tehran) and explained the characteristics of each one. Understanding the characteristics of each session is essential for short-term trading and will help you choose the best symbol to trade in each trading session. Since there is a lot of risk involved in trading in the forex market, you can use xChief International Broker’s free welcome bonus and start trading risk-free.

For more information, you can visit the Bonus xChief page.

Frequently Asked Questions

1. When is the best time to trade gold (XAUUSD) on forex? The best time to trade gold (XAUUSD) in Forex is the New York trading session.

2. What is the best time and currency pair for scalp trading in Forex? The best currency pair for scalp trading is EURUSD and the best time is to trade on the overlap between London and New York.

3. What time does the New York trading session open in Iran time? The New York session opens at 15:30 Iran time and closes at 00:30 Iran time.