Swap in the forex market

Introduction:

Swap in the forex market is an important concept that you should be familiar with. A swap refers to the interest rate difference between two currencies in a currency pair that is credited or deducted from your account when you hold a position for more than one day.

In this article we will discuss:

- Definition of swap and how to calculate it

- Types of currency swaps and cross currency swaps

- Practical examples of swaps in the forex market

- Ways to make money from swaps in Forex

- The cost of swaps and Islamic accounts

Swap in the forex market

The forex market is a global market where traders buy and sell different currencies. In the forex market, each currency pair consists of two currencies, which are called the base currency and the quote currency, respectively. For example, in the EURUSD currency pair, EUR is the base currency and USD is the quote currency. When you buy the EURUSD currency pair, you are so called buying EUR and selling USD.

Now suppose you have opened a buy position in the EURUSD currency pair with a volume of 1 lot (100,000 units). In fact, you have bought 100,000 EUR at the price of USD and given it as a loan to your broker. The broker has also given 100,000 dollars as a loan to his bank in your name. Now you have to pay interest to your broker and the broker has to pay interest to his bank. The interest rate difference between two currencies is called swap.

Swap = (volume * (interest rate of quoted currency – interest rate of base currency – markup)) divided by 100

Assume that the interest rate for the euro in this transaction is 1.6000. For example, if you want to buy EUR 100,000 and hold it for one day, the reference interest rate for EUR and USD should be considered. If the Euro interest rate for this day is 0.25% and the USD interest rate for the same day is 0.50%, you can calculate the swap as follows:

Swap = (trade value x (dollar interest rate – euro interest rate)) divided by 100

In the example below, we omitted the “markup” (extra cost).

Transaction value: 100,000 euros

Dollar interest rate: 0.50%

Swap = (100,000 × (0.50 – 0.25)) / 100

Swap = $250

To calculate the swap, you need to know the interest rates of the two currencies. The interest rate of each currency is determined by the central bank of the issuing country. The broker may also add a markup to the swap. Swap may be positive or negative. If the swap is positive, it will be credited to your account. If the swap is negative, it will be deducted from your account.

Swap is applied when you hold a position for more than one day. In this case, your position will be closed when the New York market closes and opened the next day. This operation is known as swap rollover. Some days, swaps are applied in triples. These days are called triple swap days and are usually on Wednesdays.

Currency swap :

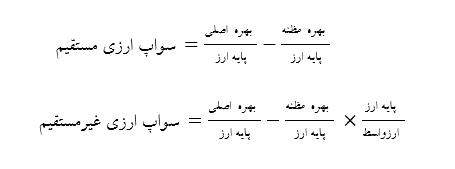

Direct currency swap and indirect currency swap

You can calculate direct and indirect currency swap using the following formulas:

Currency swap

Cross currency swap:

It is said when two parties exchange two currency pairs. For example, if you buy EURUSD and sell USDJPY, you are actually doing a EURJPY cross currency swap.

You can calculate the cross currency swap using the following formula:

Indirect currency swap + direct currency swap = cross currency swap

With the function of swaps in the forex market, you can explore ways to make money from swaps in forex. Some of the famous ways are:

– Using a carry trade strategy in which you buy a currency pair with a high interest rate and a low interest rate. (Carry trade stands for “interest rate profit transaction” or “interest rate transfer transaction”. This strategy may be used by investors as an opportunity to profit from interest rate differences between currencies.)

– Using the swap hedging strategy in which you buy a currency pair with a low interest rate and sell a currency pair with a high interest rate.

– Using the swap arbitrage strategy in which you benefit from the difference in the swap rate between two different brokers.

The cost of swaps and Islamic accounts:

The cost of swaps depends on various factors, including interest rates, market volatility, trading volume and broker mark-ups. Islamic accounts or non-swap accounts are a type of account in which swap is not applied and instead a fixed fee is considered. This type of account is suitable for those who cannot accept swap profit or loss for religious or legal reasons.

as a result:

1. Consider Swaps for Day Traders:

– It is better for traders to consider swaps in their transactions. Swap trading is suitable for people who are looking for short-term profits.

– Swap can be a source of additional income for traders and, as an opportunity, help in making decisions about currency transactions.

2. The effect of changing banking hours on swaps:

– Change of banking and swap hours can affect traders’ decisions. During times when banks are closed and swaps are not calculated, traders should be aware of additional swap fees.

– Since swaps can add additional fees to currency trading, traders may choose not to trade at times when swaps are not calculated.

Result:

Ultimately, the decision to receive or pay swaps for short-term traders depends on the specific trade and market conditions. Traders should carefully calculate and consider interest rates and swap fees for each of their trades. Also, it is important to be aware of changes in banking hours and its effect on swaps. These decisions can help traders optimize their strategies in the forex market.