Take profit “TP” in Forex

Introduction:

The Forex market is one of the most complex financial markets in the world, which attracts a large number of financial market traders day by day. In this dynamic and challenging environment, target setting and risk management are very important. This article examines the concept of target in the forex market and how to place it on the Metatrader platform, and provides you with a complete guide to setting goals and risk management in currency trading.

Determining the target is one of the important steps in the trading process in the forex market. In this section, we examine the concept of target and provide basic guidelines for setting goals in currency trading, and then we discuss how to set the target limit in the trading platform.

First part: Target concepts

1- Target definition in the forex market:

A target is defined as a goal or a point that a trader is going to reach. This goal is usually determined based on various analyzes such as technical analysis, fundamental analysis and various indicators. Setting a target helps traders achieve their expected returns more accurately and with more confidence.

2- The importance of setting the target:

Risk Reduction: Setting a target helps traders determine their maximum acceptable profit.

Optimum use of returns: Setting a target allows traders to be more productive than available returns. This allows traders to think about the balance between profit and loss when the market approaches the target.

Accurate planning: Target setting allows traders to more accurately predict their expected returns. This detailed planning increases traders’ confidence in their decisions.

3- Key points in determining the target:

Mutual analysis: Using mutual analysis means combining technical and fundamental analysis. This approach helps traders to update their decisions based on current market information and economic conditions.

Duration of the transaction: setting the target should be in harmony with the duration of the transaction. Short-term and long-term trades require different strategies and targets.

Effects of news: Traders should consider the effects of news in determining their target. Economic news and world events can strongly influence price changes.

4- Strategies for determining the target:

Fibonacci strategy: Using Fibonacci levels as target points may be effective in technical analysis.

Pivot Strategy: Pivot points can act as effective targets for traders.

Use of indicators: Technical indicators such as moving average, RSI and MACD can help traders in setting targets.

Use of support and resistance levels: Support and resistance levels can act as a barrier against the price, and traders can determine their target level by identifying supply and demand levels (resistance and support levels).

Use of volume indicators: volume levels (VAH and VAL) can act as resistance and support levels and traders can determine their target level from these levels.

Risk-Reward ratio:

The ratio of risk to profit is one of the basic concepts in financial transactions, including in foreign exchange markets or forex. This ratio is defined as how much of the profit may be taken as risk in the trade. In financial terms, this ratio is known as “Risk-to-Reward Ratio (R:R)”.

How to calculate the risk-to-profit ratio:

The risk-to-profit ratio is calculated by dividing the amount of risk in case of failure by the amount of possible profit in case of success. Its formula is as follows:

(Amount Risk)/(Amount Profit) = R:R

Example:

Suppose you make a trade in the forex market and you want to calculate the risk-to-profit ratio. in such a way that:

Amount of risk: 50 pips (changes in the range of the currency pair)

Profit amount: 100 pips

Now the ratio of risk to profit will be as follows:

R:R= 50/100 = 0.5

Here the risk-reward ratio is 0.5. This shows that each unit of risk represents 0.5 unit of profit.

Interpretation of the risk-benefit ratio:

- Higher ratio: If the risk-to-reward ratio is greater than 1, it means that you will have more profit than your risk if you succeed. This is seen as a strong point in your trading strategy.

- Lower ratio: If the risk-to-reward ratio is less than 1, it means that you will have less profit than your risk if you succeed. This may be perceived as too much risk by some people.

Second part: How to set profit limit and loss limit in Metatrader platform

There are several ways to enter the profit limit (Target).

1- When starting the transaction, set the profit limit:

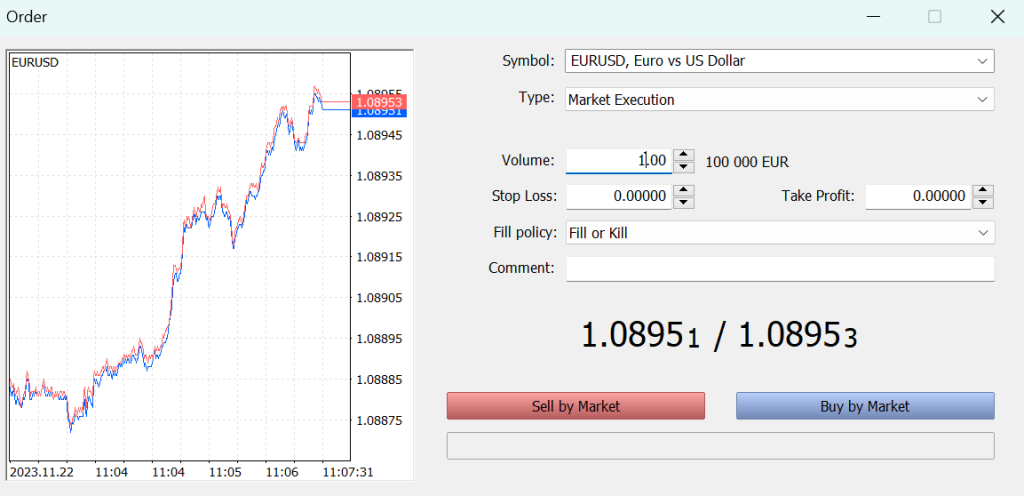

By pressing the F9 key on your computer keyboard, the window related to buying and selling settings will appear, or from the top bar of the Metatrader platform, click on the Tools section and a window will open that shows “New Order”. Click on it and the following window will appear.

How to set profit limit and loss limit in Metatrader platform

In this window and in the “Take Profit” section, you can specify the profit limit. Note that the pip amount should not be written incorrectly in this section and the profit limit price should be written.

After entering the profit limit, you can activate the purchase order by clicking on the blue “Buy by Market” bar.

2- After entering the transaction, set the profit limit:

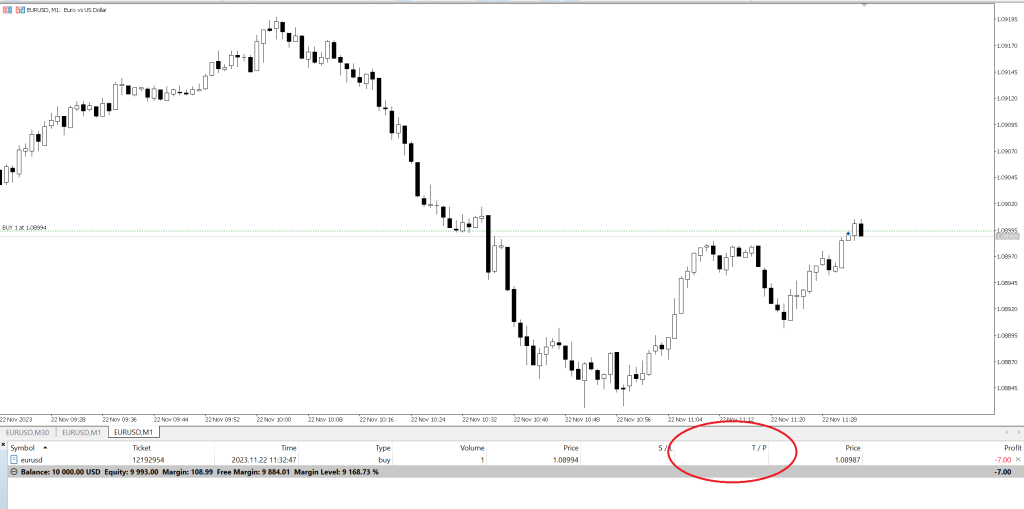

When you activate the “Buy by Market” option, it will appear on the chart of the purchase transaction as shown below, but now we need to record the target in the target field. There are several methods for this purpose.

How to set profit limit and loss limit in Metatrader platform

3- Determining the target limit by dropping the entry price:

Click on the green dashed line which is the purchase price and drop it upwards, you will see that the target number is recorded in the bottom bar in the T/P section.

How to set profit limit and loss limit in Metatrader platform

4- Determining the target limit by double-clicking on the price line on the chart or double-clicking on the T/P bar at the bottom of the chart:

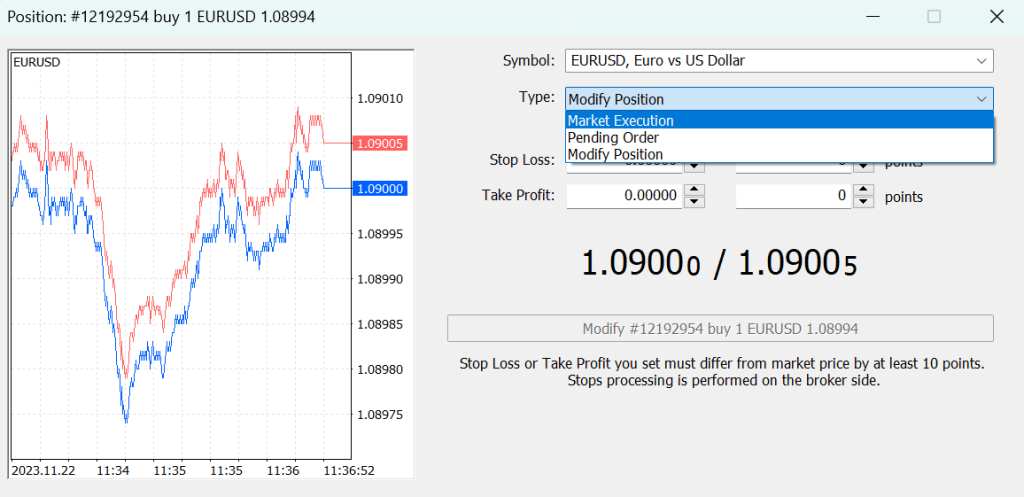

Double click on the green dashed line, which is the purchase price, so that the following window appears.

How to set profit limit and loss limit in Metatrader platform

Now, you can specify the profit limit with the amount of pips, for example, put the number 60, it represents a profit of 6 pips, or type the profit number in the Take Profit section.

Note: You should note that if the above window opens as shown below, you must set it to “Modify Position” with the slider bar as shown below.

How to set profit limit and loss limit in Metatrader platform

And then in the figure below, the price hit the desired target and automatically exited the trade with profit.

How to set profit limit and loss limit in Metatrader platform

Result:

As a comprehensive guide in the field of target setting and risk management in the forex market, this article will help both novice and professional traders. By reading this article, your forex trading skills and knowledge will improve and help you make better decisions to succeed in the forex market.