Pips in forex

Introduction:

One of the most important terms in forex that you may have seen before on various forex analysis or training websites is pip. But what is a pipe? What is its use? Why should you pay attention to it?

In this article, we’re going to take a look at Forex Pips. Stay with us.

In various capital markets, such as the stock market, cryptocurrency, etc., “percentage” is usually used as a unit to evaluate the amount of price changes. For example, a company’s stock may rise by 2% one day, or the price of a cryptocurrency such as Bitcoin may fall by 0.5%. In fact, “percentage” helps us to understand well the decreasing or increasing trend of the price of a share or a cryptocurrency. Also, with the help of “percentage” we can know the amount of profit or loss we had in the transactions.

About the forex market, the case is different. In this market, we are dealing with currency pairs, and “percentage” cannot be an accurate measure to evaluate the price change of one currency to another. For this reason, we have to use another unit for a more accurate and fundamental evaluation of the price changes of currency pairs in Forex.

What is a pip in forex?

The standard unit for measuring the amount of price changes of currency pairs in the forex market is called Pip (PIP). Pip is an abbreviation of the English term Price Interest Point. The value of currencies is constantly changing based on the amount of supply and demand globally, and in the forex market, it is the pip that shows us the amount of these changes with high accuracy.

Pip calculation in forex

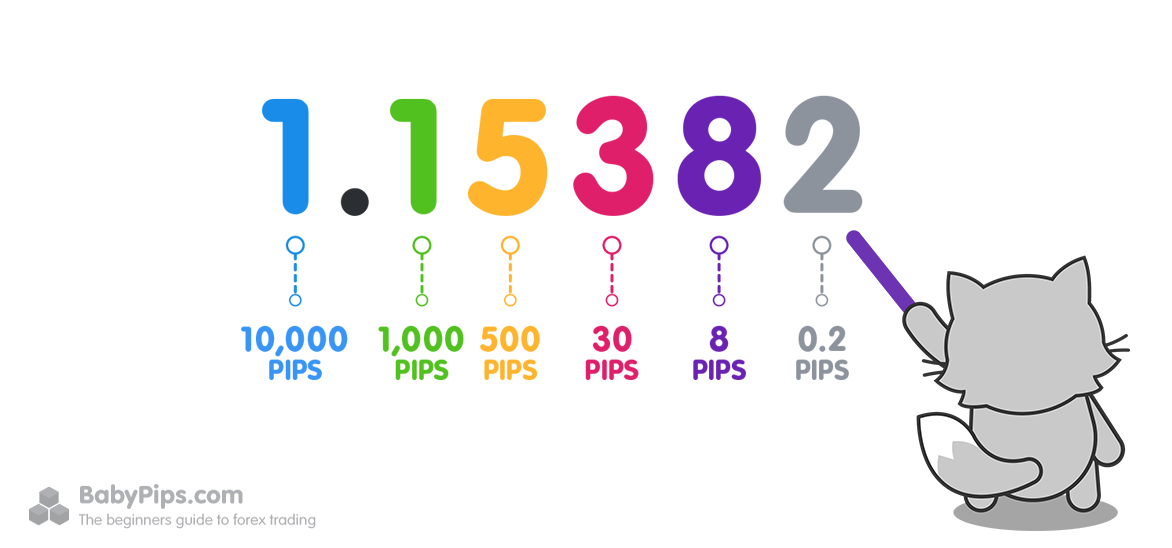

Let’s look at an example first. Generally, forex brokers display the price of currency pairs in the form of a four- or five-digit decimal number. Consider the EUR/USD currency pair. If the price of this currency pair is equal to 1.07821, that means the price of each euro is equal to 1.07821 dollars.

As you can see, we have five more digits after the decimal point. Therefore, the pip in this currency pair will be the fourth digit after the decimal, i.e. 2.

Now suppose that after one hour, the value of this currency pair will reach 1.07862. Thus, the pip will be equal to 6. That is, within one hour, the price of the EUR/USD currency pair has changed by 4 pips (obtained by subtracting 2 from 6).

Pips in currency pairs including Japanese yen

There is one very important exception, and that is for currency pairs where one side is the Japanese yen. For example, consider the USD/JPY currency pair. In the platform of forex brokers, they use only two or three digits after the decimal point to display currency pairs that include the Japanese yen. In such currency pairs, the pip is the second digit.

For example, if the price of USD/JPY currency pair is equal to 144.139, the pip here will be equal to 3. Now, if after a few minutes, the price of this currency pair reaches 144.113, we say that this currency pair has decreased by 2 pips (the result of subtracting 1 from 3).

In short, by considering the fourth digit after the decimal point in the price of currency pairs (and of course the second digit after the decimal point in currency pairs including the Japanese yen), we can easily calculate pip in Trading View or other forex trading platforms.

What is a pipette in Forex?

Maybe sometimes you have seen the term “pipette” and thought that it was the same pipe and there was a typo. This is not the case and there is actually a term called pipet in the forex market. The pipette is used when we need to examine more closely the amount of changes in the price of currency pairs. This issue is especially important in analyzing the price movement of currency pairs or calculating the amount of profit and loss of transactions with high figures. For this purpose, we have another unit called Pipet.

If we consider pip as something equivalent to “percentage” in stock and cryptocurrency markets, pips will be equivalent to “tenth of percent”.

Let’s go back to the first example. We saw that the price of the EUR/USD currency pair was equal to 1.07821. Here, the fourth digit after the decimal point (i.e. the number 2) is the pipe and the fifth digit (i.e. the number 1) is the pipette.

In other words, every 10 pipettes is equal to one pip.

In currency pairs including the Japanese yen, we call the figure after the pip (i.e. the third figure after the decimal) as the pip. In the previous example, where the price of the dollar/yen currency pair was equal to 144.139, the third digit after the decimal point (i.e. 9) is pips.

How much is each pip worth?

Since each currency has its own relative value, it is necessary to calculate the value of a pip for a specific currency pair. For example, let’s say that at the end of one day’s trading, we have made a profit of 6 pips. What is the exact dollar value of this pip?

Generally, forex trading platforms as well as some online calculators will display the dollar value of the amount of profit you have made. However, knowing how to calculate the value of each pip can help you to better understand this unit.

Calculate the value of each pip

The calculation of the value of each pip depends on the volume of the transaction and the base currency, for example, the dollar in the USD/EUR currency pair. The general formula is that each pip is worth $10 per $10,000 trade. So, if we entered a trade with $10,000 and made a profit of 6 pips, we have actually made a profit of $60.

Of course, you don’t need to do such a calculation manually. With a simple internet search, you can find online calculators that will help you calculate the exact dollar amount of pip. It is enough to give the volume of the transaction and of course the currency pair you want to one of these calculators to determine the value of each pip. Of course, in most of these calculators, the transaction volume is requested based on US dollars, so that the value of each pip is also calculated based on the same currency.

Pips in gold forex

Finally, there is an important point about the gold forex market, and that is that most forex brokers consider each pip in gold trades to be equal to one cent. In other words, if we lose 100 pips in the gold trade, this amount is equal to one dollar.