How to calculate the loss limit in the forex market

Introduction

The forex market is a global financial market with unique features that enable foreign exchange transactions between all types of currencies. One of the basic principles of trading in this market is to limit losses and increase profits. In this article, we will examine how to calculate the loss limit in the forex market.

First part: The concept of loss limit

A stop loss, as a risk management strategy, is the maximum amount of loss a trader will accept to participate in a particular trade. Using a stop loss protects traders against unwanted market fluctuations and enables them to make smarter decisions.

Second part: How to calculate the loss limit

1- Trading percentage

One of the ways to calculate the loss limit is to use the trading percentage. This method allows the trader to consider a certain percentage of the capital as a loss limit. For example, if a trader has decided to lose a maximum of 1% of the capital in a trade, or in other words put it at risk, the calculation of the loss limit will be as follows:

Limit = total capital ∗ trading percentage

2- Real average calculation of loss limit

In this method, the trader uses the real average analysis of the market movement in different time frames. This calculates the stop loss based on the actual points of the market movement at different times and gives the trader more accurate information about the current stop loss.

How to specify the transaction volume (lot size) in Forex ?

Before we talk about the trading volume in Forex, it is better to make sure that you are familiar with these terms: Position, Pip, Lot, Equity, Balance.

Position: A position in Forex refers to a transaction that you open in the Forex market (exchange of currencies). When you open a position in Forex, it means that you are buying or selling a currency pair.

For example, if you open a buy position for the EUR/USD currency pair, it means that you are buying the euro currency by paying the dollar currency. You hope that the euro currency will find a price against the dollar so that you can sell it at a higher price in the future and make a profit.

Conversely, if you open a sell position for the EUR/USD currency pair, it means that you are selling the euro currency at the current price in the hope that its price will decrease against the dollar in the future. You can then buy the Euro currency at a lower price and earn the price difference as profit.

Every forex transaction has two sides: a buying side and a selling side. Anyone who opens a position is known as a “trader” in the transaction. Your position will remain open until the trade closes and you can see your profit or loss at that time.

Pip: (pip) is a small unit of measurement used to show price changes. The name “pip” is short for “Percentage in Point” or “Price Interest Point”. A pip is usually associated with one tenth of a decimal place in a currency’s price.

Most forex currency pairs are shown as four decimal places, such as 1.1234. In this case, changing one pip means changing the last decimal place. For example, if the price goes from 1.1234 to 1.1235, we have a change of one pip.

If the currency pair has five decimal places, such as 1.12345, a change of one pip is represented by the change in the last decimal place.

The pip unit refers to the measurement of changes in price, and the changes are calculated separately from the number of pips. For example, if the price goes from 1.2000 to 1.2010, we will see a change of 10 pips.

Equity : Equity is equal to Balance plus Floating Profit/Loss. Floating profit or loss represents changes in the value of your open trades, but not yet closed.

Balance : This amount represents the total amount of money in your forex account . This includes the initial deposit amount (the money you deposited) and any fixed (closed) profits or losses from past trades.

The appropriate trading volume in forex means the number of units suitable for buying and selling a financial asset, in simple words, what volume is suitable for trading in forex with the amount of your capital and risk?

Any trader can easily control and manage the risk in forex trading. Risk management is one of the important keys to success in trading.

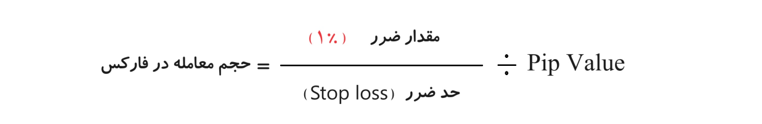

Below you can see the formula for calculating the transaction volume .

The formula for calculating the transaction volume

Don’t worry about calculating the amount of risk, because we will teach you how to calculate with this formula with an example, and at the end, we will introduce you to a capital management expert that automatically determines the amount of the lot size, because the prices are changing rapidly, the trader will not have the opportunity to calculate for each transaction in his trades and must use capital management programs, which we will discuss at the end.

The concept of trading volume and risk in forex

Before we start how to calculate the volume of trading in forex, you should know the concept of volume or position size and risk in forex.

Transaction volume

The transaction volume is the same amount of money that you have to pay to the lot to buy and sell a currency pair, the amount of volume in each transaction is directly related to your initial and available capital and the amount of risk in each transaction.

risk management

Trading in each of the financial markets is associated with a certain amount of risk, all traders accept a certain amount of risk during the trade due to the prediction of the price movement in the future and the certainty of their analysis, and they enter the position with a certain amount of their capital in each transaction. Therefore, in each transaction , we will enter into the transaction according to risk management .

If we operate using risk management, we always keep losses small and profits large, for example, let’s say you are going to trade a currency pair, in this case, if you set your profit limit to 60 pips and your stop loss to Set 8 pips, if you are wrong you will lose 8 pips, but if your analysis of the price trend is correct you will gain 60 pips.

Now, should these 8 pips as a loss limit be 1% of your capital balance? And now how should we calculate?

In the following, we are going to answer it with how to calculate the volume of trading in forex.

Information needed to calculate the volume of trading in forex

To calculate the trading volume in Forex, you will need the information given in the figure below.

Balance or equity, traded symbol or currency pair, risk percentage (1% maximum), pip loss limit, currency pair exchange rate (Pip value).

How to calculate the volume of trading in forex

The first thing you should pay attention to when calculating the volume of transactions in forex is whether the currency unit you use in your trading account is the same as the base currency or the counter currency or not. (In most brokers, you can choose dollars or euros as the currency of the account.) Remember that the value of a currency pair is in terms of the mutual currency.

Suppose that your initial capital is $1000 and you have deposited it into your broker account and you are going to make a trade on the EUR/USD currency pair.

To get the volume, we use the formula you saw above, but first, before we put the numbers in the formula, we must first get the risk of this transaction in relation to the initial capital.

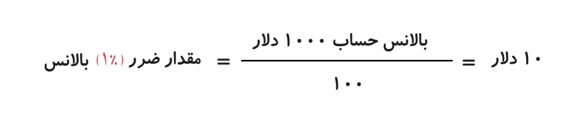

Capital management must be observed here and it is better not to enter more than 1% of your total capital in one transaction, so:

How to calculate the volume of trading in forex

Balance = 1000 dollars

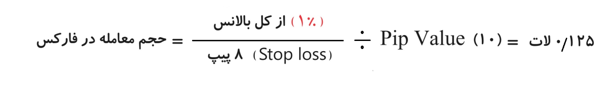

The stop to pip value can be set from the entry price to the limit we specified with the “Crosshair, Cnrl+F” tool on the Metatrader platform in the toolbar. Stop amount = for example 8 pips

Stop amount = $10

pip value = every currency pair whose one side is the dollar has the same pip value. In “euro dollar” this value is 10 .

How to calculate the volume of trading in forex

Introduction of capital management expert and use in Metatrader platform.

Conclusion

In forex trading, calculating the loss limit is one of the most important steps for successful risk management. Using the right methods to calculate stop loss allows the trader to make smarter decisions and reduce unwanted risks.