Forex FTR training

Introduction:

The FTR pattern is one of the famous patterns in the forex market, which is used to find entry and exit points. This method is based on analyzing price charts and identifying price patterns. This means that the price crosses a support or resistance level but fails to pull back to that SR level.

An overview of the FTR pattern :

In this method, FTR stands for “Failure to Return”. In other words, this method focuses on the principle that whenever the price reaches a certain level, there is a high probability that it will return to the previous level. This level can be a line on a chart or a price pattern.

In the RTM trading style, the FTR pattern is the second most powerful pattern after the flag-limit pattern. This pattern does not have a single schematic like the classic Crown or Head & Shoulders patterns, twins, triangles, etc., and is based on the structure of price candles. Recognizing this pattern also requires practice and repetition.

What is the FTR strategy ?

The FTR strategy is a technical analysis method used to identify trading opportunities. This method focuses on the idea that the market tends to move in cycles, and these cycles can be identified by analyzing price patterns. The FTR strategy is designed to help traders identify these patterns and exploit them.

The FTR strategy is a fairly simple method that can be used by traders of any skill level. This method involves identifying key levels in the price chart and looking for price patterns that indicate a pullback or correction. After identifying a pullback or correction, traders can enter trades and set stop-loss and take-profit levels.

Advantages and characteristics of FTR strategy :

One of the key advantages of the FTR strategy is that it is a high win rate method. Because traders are looking for pullbacks or corrections, they can enter trades with small stop amounts.

Another advantage of the FTR strategy is that it is a versatile method that can be used in different market conditions. To identify trading opportunities, regardless of whether the market is moving up or down, traders can use the FTR strategy to identify trading opportunities, and FTR shows the direction and trend of the price with its formation pattern.

One of the most important advantages of trading in the FTR pattern is that it is formed in line with the trend, and because it is formed in line with the trend of this pattern, the probability that the price will stay on the track again after the FTR pattern and continue its trend is very high.

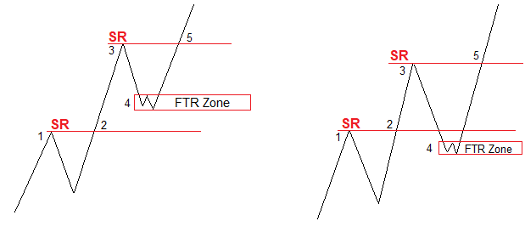

FTR pattern recognition

In the FTR pattern, we first have a minor or major SR, which the price engulfs this level with a strong momentum candle and forms a new minor/major SR. After the formation of the new SR level, the price returns to the first SR. But the price cannot hit this level again and enters the base range in the middle. The price then breaks out of this base area, re-engulfs the second SR with strength, and continues the initial market movement. It is expected that in the future the price will return to the zonal area formed between the two SR levels and react to this area. In fact, the formed base region is called FTR.

According to the above, there are four conditions for the formation of the FTR pattern:

- Formation of first SR levels

- Strong Ingalf at first SR levels

- Formation of the second minor or major SR

- Market return from the second SR and formation of FTR Zone

Bullish FTR pattern :

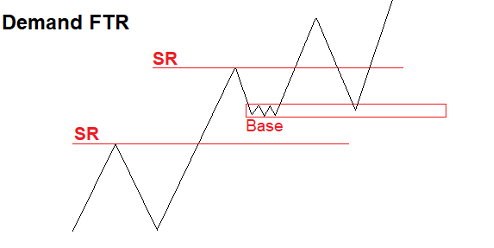

In fact, we have two types of FTR patterns, FTR in the demand area and FTR in the supply area. The structures of these two patterns are given below. In the figure below, the FTR pattern is formed in the demand area.

Bullish FTR pattern

The price of the first SR level is broken with strength and a new SR level is formed (upper SR). The price then tries to pull back to the previous SR that was broken, but the price completely fails to reach the level of the first SR, thus forming a new base (demand). The movement of the market from the base causes the upper SR to be broken. If the price returns to the base zone (FTR Zone), we enter the buy trade, because we expect the market to make a strong upward movement from this zone.

Note: Remember that it doesn’t matter if the bass region is formed between two SRs or below the first SR . First, the stages of FTR formation should be followed in order, and then the engulfment of both SR levels should be strong with a strong momentum candle.

Bullish FTR pattern

In the figure above, both figures represent the demand FTR. Because it includes the conditions for the formation of the FTR pattern structure. The FTR supply zone is the opposite of the demand zone.

First SR (resistance) is broken, then new resistance (SR) is formed. Then the demand or base area is created and after that the new resistance is broken with strength. Now, if the price hits the demand or base area, we enter into a buy transaction.

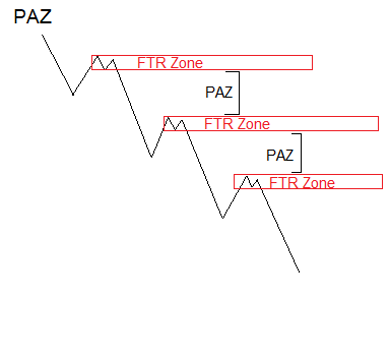

Price movement areas or PAZ

The term PAZ stands for Price Action Zone and the areas between the FTR zones are called the PAZ level. In the picture below, the PAZ levels between the two levels of the FTR Zone are specified, and in the picture below, you can see the stepped FTR. This means that during the downward or upward trend, several FTR Zones are formed consecutively, and that is why it is called a stepped FTR. In some cases, the price does not even reach the FTR area and a stepped FTR is formed, as shown below:

Price movement areas or PAZ

Result:

FTR strategy is one of the famous methods in the forex market, which is used to identify entry and exit points. This method is a relatively simple and low-risk method that can be used by traders of any skill level, it is important to remember that the FTR strategy is not a foolproof strategy and like any other trading method, there are limitations and risk. and traders should always use proper risk management techniques and never risk more on a trade than they can afford to lose.