Copy trading in Forex

Introduction:

Copy trade is a new method in financial markets that allows people to benefit from the experiences and decisions of professional investors. This concept has found a special place, especially in foreign exchange markets. In this article, we will examine the concept of copy trading in Forex, its advantages and disadvantages, how it works, and how to participate in this process.

Definition of copy trade:

Copy trade means imitating the business of professional and successful people. In this method, a person or investor (usually anonymous) can recreate and execute the trades, strategies and trading decisions of a professional trader. This allows ordinary people to benefit from the knowledge and experience of others without having their own professional experience.

How copy trade works in forex :

1- Choosing a copy trade service :

Starting to copy trade usually starts with choosing a copy trade service. These services usually act as intermediaries between professional traders and ordinary people.

Of course, the first step or “choosing a copy trade service” is very important and plays an important role in your overall copy trade experience. At this point, you are looking for a copy trading service or platform that allows you to copy trade with professional traders. Below are more details on this step:

Choosing a copy trade platform or service:

1- Research and review: Before choosing any copy trading service, it’s best to do your research and check out a variety of different services and platforms. Make sure the service you choose is reputable and reliable enough.

2- Features and facilities:

Check out what features and facilities the service offers. For example, is it possible to choose from different professional traders? Is trader performance data available?

3- Fees and charges:

Compare what each service charges for their services. Also, check for other fees that may affect the transaction process.

4- Customer support:

Customer support is very important here. Make sure you choose a service or platform that has strong and effective support to help you with any issues or questions you may have.

5- Security facilities

The security of your account and information is vital. Check what security measures the Service has in place and how it will ensure that your information is protected.

6- Comments and feedback:

The comments of the previous users of the service can be a valuable resource for a better understanding of the service’s performance and acceptable features. Try to read independent reviews and not just the reviews on that service’s website.

7- Compatibility with trading account:

Make sure that the service or platform in question is compatible with your trading account or the trading account you intend to connect to.

2- Registration and connection to trading account :

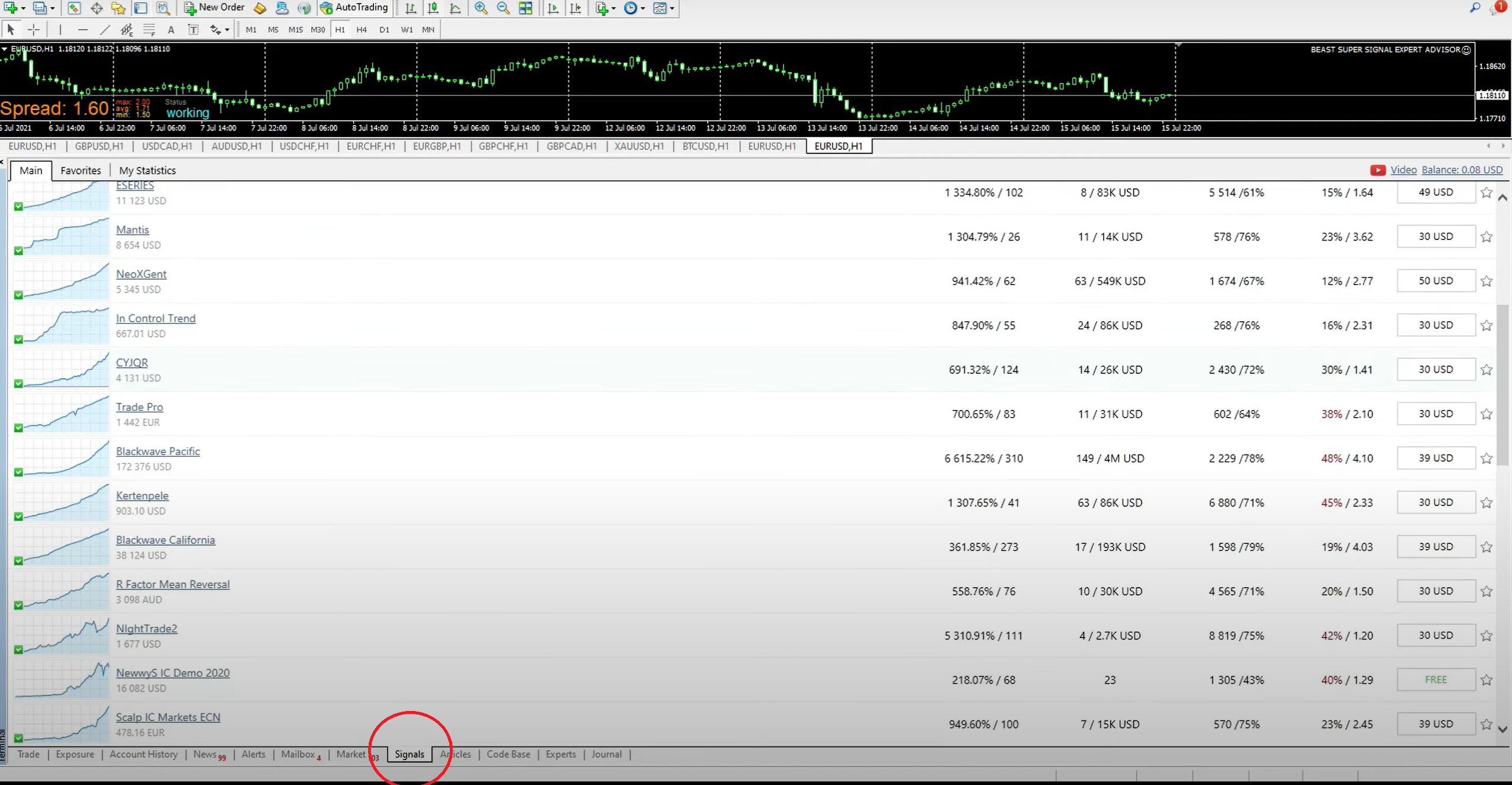

After choosing the service, people need to open their trading account and connect it to the copytrade system. This connection is done through API information or other technologies. First, join the MQL5 site so that traders offering copy trades will be displayed for you in the “Signal” section of the Tolbax bar.

3- Selection of professional traders :

People should choose the professional traders they want to copy trade. This selection is based on various factors such as performance history, trading strategy, and risks associated with each trader.

How to copy trade in forex

By clicking on the profit growth curve (on the left), you will be taken to the profile of the signal provider.

It is important to pay attention to these points:

- The signaller you choose should have a Rail account.

- Do not exceed 10% in the signaler’s account.

- Their equity should not exceed 5%.

- The number of transactions at the same time should not be large.

- Balance growth should be acceptable and reasonable.

- The risk of each transaction should not exceed 1%.

Some brokers introduce investment accounts that traders can use as signal providers or signal receivers.

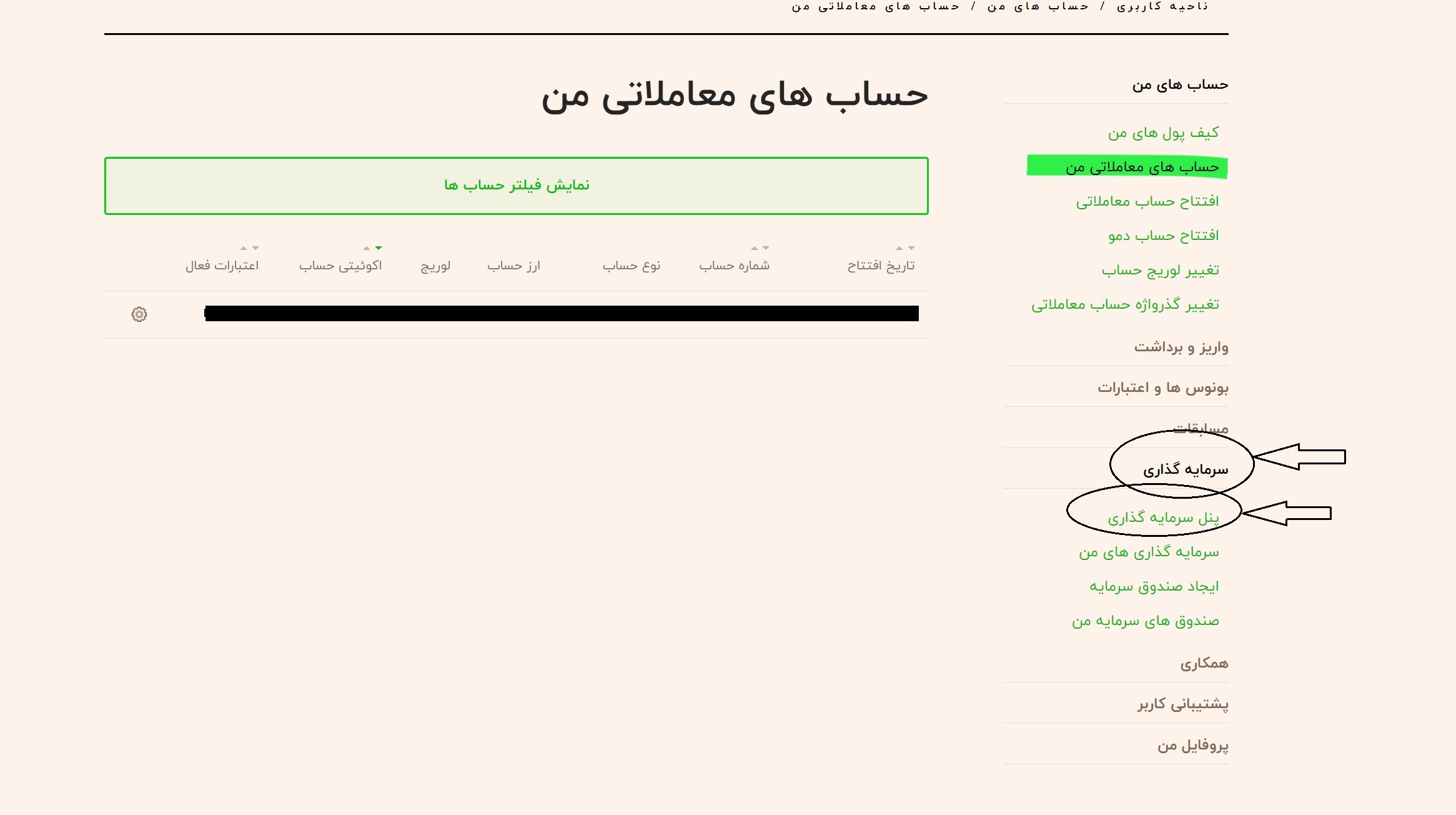

In this section, we use ” Forex Chief ” broker as an example, opening an account in this broker is a very simple task.

- Create an account for yourself.

- Log in to your account.

- From the menu on the right, click the drop-down triangle related to the investment menu to open the investment window for you.

How to copy trade in forex

4- Click the investment panel. On the left side of the picture, boxes with the title of investment are written. By choosing the trader of your choice, you can click on the investment option to enter its details.

How to copy trade in forex

5- Details are displayed in the figure below, the amount of the trader’s bonus, etc. can be seen on this page. To accept the conditions of this investor, you must click the green box “Invest” to activate the subscription for you.

How to copy trade in forex

4- Start copy trading:

After completing the above steps and subscribing to the “Subscribe” of your chosen trader, people can automatically copy the trades of professional traders. Any changes in the trader’s arrangements are also applied to the account of the copiers. You can choose any trader you want and “Unsubscribe” the previous trader from your subscription.

Advantages and disadvantages of copy trade:

Advantages:

– ease of use: People without the need for special knowledge and experience can benefit from the efficiency of professional traders.

– Reducing time and research: There is no need to analyze all types of financial markets and review analytical documents; All this information is available to the individual through copy trade.

– Suitable for busy people: For people who have little time to take a variety of trades, copy trade is a suitable solution.

Disadvantages:

– financial risk: Like any investment activity, copy trading also comes with financial risks.

– Dependence on professional traders: People’s performance will usually be based on the decisions of professional traders, which may change in some circumstances to affect the people’s performance system.

Conclusion:

Copytrade is a powerful tool in the financial world that allows you to gain professional experience without the need for extensive financial education. However, it is necessary for people to carefully evaluate the risks, advantages and disadvantages before starting this process and make favorable decisions based on their financial goals and financial capabilities.