Correlation of currency pairs in forex

Introduction:

As we know, the forex market is known as one of the most profitable and liquid financial markets around the world. However, becoming a successful trader in this market requires sufficient knowledge of its basic concepts. One of these important concepts is the correlation of currency pairs in forex. Understanding and monitoring the correlation of currency pairs can affect the amount of trading risk; So it is very important for every trader to be aware of it.

In this article, we will examine how to determine and calculate the correlation of forex currency pairs and its effect on transactions.

What is the correlation of currency pairs in forex trading?

Correlation of currency pairs in forex means the relationship between two currency pairs in terms of value and direction of price movement. Since currencies in forex are priced in pairs, no pair is traded completely independently of other pairs. Correlation can be positive or negative.

If the price of two currency pairs increases or decreases at the same time, it means that these currency pairs move in the same direction. In this case, we say that their correlation is positive.

If two currency pairs move in opposite directions, i.e. often when the price of one increases, the price of the other decreases, these two have a negative correlation. Negative correlation is also called inverse correlation.

Important note: two currency pairs are correlated when this relationship is observed between them most of the time; It means that they should not move randomly and only some of the time in the direction or opposite of each other. If the currencies do not have a clear relationship with each other, we call them uncorrelated.

Why is it important to know the correlation of currency pairs?

Understanding the correlation of currency pairs can have a direct impact on the results of forex trading. For example, suppose a trader buys two different currency pairs that are positively correlated. In this case, if the price of one of those currency pairs decreases, due to the positive correlation between them, the price of the other currency pair will also decrease. In this case, the trader will lose in both of them. Of course, the good thing is that if one of them rises, the other will rise and the trader’s profit will be doubled.

Conversely, when two currency pairs are negatively correlated, a profit in one of them means a loss in the other. In this case, if you have chosen the right currency pair, the amount of profit of the pair whose price has increased may compensate the loss of another. They often refer to choosing two currency pairs with negative correlation as a risk hedging strategy.

What is the correlation coefficient?

To understand the correlation coefficient, think that the correlation can only say that two currency pairs move in the direction of each other or against each other and cannot show the exact value of this relationship. But the correlation coefficient accurately specifies its value and shows how strong or weak the correlation between two currency pairs in Forex is. Correlation coefficients are represented by values ranging from -100 to 100 or -1 to 1.

The closer the correlation coefficient is to 100, the more these currency pairs move almost identically. Similarly, if the correlation is closer to -100, it means that the currency pairs are moving almost equally in the opposite direction. When we say almost the same, it means that the correlation of these currency pairs, whether positive or negative, is strong. The closer the correlation coefficient is to zero, that means those currency pairs have no special relationship with each other or if they have, it is insignificant.

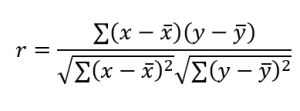

Correlation coefficient formula

It’s true that this formula sounds a bit complicated, but the general idea is that it takes data from two currency pairs x and y and then compares them to their average price readings ie. The denominator is the fraction of the covariance formula and the denominator of the formula is the standard deviation. In this formula:

The correlation coefficient is r, x and y are the closing prices of the two selected currency pairs, and the average of several closing prices for those currency pairs.

Let’s clarify with an example.

Let’s say the data is the closing prices for each day or hour. The closing price of x (and y) is compared to the average closing price of x (and y). Now we enter these values in the formula. To get an average, we need to track several prices in a certain time period in Microsoft Excel software. Once the closing prices are recorded, an average can be determined that is constantly updated as new prices arrive.

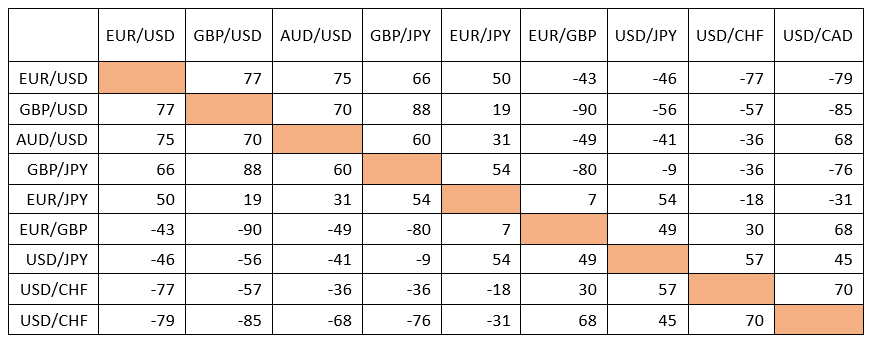

Correlation table of currency pairs in Forex

The following table shows the correlation table of currency pairs in Forex in some of the pairs that have the largest volume of transactions in the world. You can compare each currency in the columns to the currencies in the rows to see how they correlate. For example, the correlation between EUR/USD and GBP/USD is 77, which is very high.

As another example, the correlation between GBP/USD and EUR/GBP is -90, which indicates that their negative correlation is very strong. So they move in opposite direction most of the time.

The first two currency pairs in the example above don’t always move in exactly the same direction, but they often do. In comparison, the second two currency pairs, which have a strong negative correlation with a coefficient of -90, move in opposite directions most of the time (not always).

Therefore, it is important to monitor the correlation of currency pairs; Even in this small table as an example, several strong correlations are observed. If a trader buys the GBP/USD currency pair and sells the EUR/GBP currency pair regardless of the correlation of the currency pairs, it is true that he has opened two different positions (one buy and the other sell), but with the correlation coefficient of this Two, which is -90, is likely to win or lose on both. But what is the reason?

If you buy the GBP/USD pair, you are buying pounds. If you sell the EUR/GBP pair, you are still buying pounds.

Due to the strong negative correlation between these two, if the price of one of them increases, the price of the other decreases. Therefore, due to the selection of the type of position and the type of currency pair, you either gain in both or lose in both.

final word

According to what we have said, knowing the correlation level of forex currency pairs is necessary to have a successful trade in this market. This directly affects the risk level of your trades; So don’t neglect to learn it.